Get Title Loans Near Me With Dime Alley Today

Get a Loan Secured Against Your Car

Apply Online for a Car Title Loan today even without good credit!

Borrow $600, $800 or $2000 against your car, bike or truck and repay in 1, 6 or 12 months.

Submitting an online application for Title Loans is quick, easy and doesn’t affect your credit score.

How Do I Get a Title Loan Today?

To Get a Car Title Loan with Dime Alley, just follow these 3-steps:

What Should I Consider Before I Apply?

Before applying for Title Loans with Dime Alley, you should consider the following:

Whether you urgently need the loan, how you will pay it back, and what will happen if you fail to.

Your credit record will determine the terms you are offered on your loan. The stronger your credit history, the lower interest you are likely to be offered.

Whether you could seek the funds elsewhere, such as from friends and family.

Whether you want to go for a title loan, which is secured against your car, truck, van or motorbike, or whether a payday loan or installment loan would better suit your needs.

Can I Get a Title Loan with Bad Credit?

If you have a bad credit score, don’t worry – you can still get a title loan!

With Dime Alley, all credit histories are accepted. This means that you should still request a payday loan with us even if you have already been turned down by a bank because of bad credit.

Can I Get a Title Loan with Bad Credit?

Yes, you can get title loans with bad credit when you apply with Dime Alley.

Our lenders work with borrowers with all kinds of credit scores and histories – good and bad – so don’t let a poor credit score stop you from applying online today.

In fact, if you have bad credit and get an auto loan with Dime Alley, if you make sure you repay your loan on-time and in full, it could actually help to improve your credit score! This is because our lenders and any future lenders will see that you are a responsible borrower.

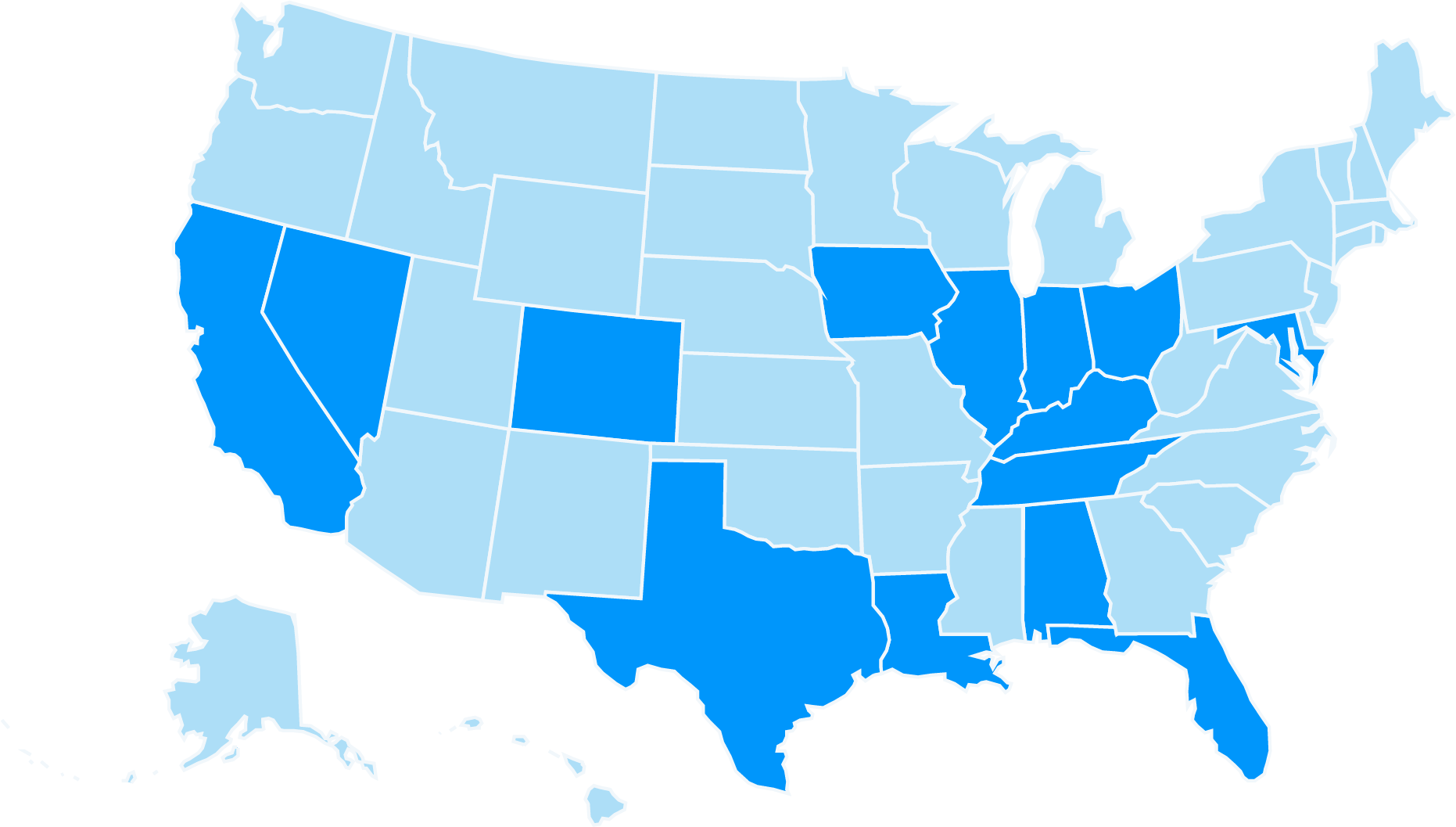

Where Can I

Borrow Money Near Me?

We proudly operate in the following US states:

What is a Title Loan?

A title loan is a secured loan that lets borrowers use their vehicle as collateral. Since your car secures the loan repayment, the lender can repossess your car if you don’t repay the loan on time.

Unexpected situations or emergencies can wreak havoc on your financial life, but they shouldn’t define your future. Car title loans offer a quick cash solution using your vehicle’s title as collateral. You can use the title on your car, RV, or motorcycle to get a title loan.

When you apply for a Title Loan with Dime Alley, our trusted panel of lenders will take your situation into account and help you borrow online ASAP.

Apply Free

When you apply for Title Loans with Dime Alley, you won’t be hit with any hidden fees. If one of our lenders approves your application, we will receive a commission from them.

Reliable

We only work with fair and legit lenders, making sure you are being offered good rates.

No Stress

Through our soft search service, we assess your application and credit history without it impacting your credit score.

Can I Get a Title Loan in California CA?

Yes, you can get a Car Title Loan in California!

Title loans in California work similarly to title loans in other states although California has stricter laws which protect you, the borrower.

Generally, title loans work by providing a loan amount of 25% to 50% of the vehicle’s value and using your vehicle as collateral. Because they are secured loans, the lender can repossess the car if you fail to meet the terms of the loan.

California has a few consumer protections not offered in other states, but the general process is the same. Some of these protections include:

- Title loans cannot be less than $2,510.

- Requiring lenders to inform you of all fees and interest before signing an agreement.

- Interest rates cannot exceed 30%.

- If the vehicle is repossessed, the lender must inform you of their intent to sell within 15 days to allow renegotiation.

If the car is sold for more than you owe, the lender must return the extra money within 45 days. If they sell it for less, you are required to pay the remainder of the loan.

How Quickly Can I Get a Title Loan?

You could have your loan in your account the very same day you apply for it!

When we receive your application, we connect it with one of our regulated lenders who we deem a good fit for you. We aim to find you a match within 24 hours.

You can borrow anywhere from $100 to $35,000 with us, depending on the state you live in and the agreement you have with your lender.

Am I Eligible For a Car Title Loan?

You can apply for a loan with Dime Alley as long as you meet these following four requirements:

- Are over 18 years of age

- Have American citizenship

- Have a minimum monthly income of $800

- Have a current account for us to deposit funds into

How Do I Repay My Title Loan?

Repayments on your title loans will be withdrawn from your checking account on the same day every month until you have paid off the loan and accompanying interest. You and your lender will agree on this date together, but most opt to choose their pay day.

It is important that you keep up with your repayments to prevent the title of your car being issued to your lender.

Payments are made in equal amounts and you have the ability to pay your loan off early if you can. However, you should be clear on the repayment terms before deciding to alter your repayment plan.

What People Say About Us

![]()

“I found Dime Alley on Google and applied in a few minutes. I got an instant decision and approved on the same day and was able to pay to have my car repaired immediately. I paid back the loan in 2 weeks and was sorted.”

Bob, Florida, July, 2021

![]()

“Had a good experience and got my loan the next day. I needed it to pay my bills and will consider using it again if I need a loan.”

Darryl, Michigan, February 2023

![]()

“Personal and friendly, they did what they said they would do, I was approved for a loan although I have bad credit. It was just a short term thing, but has helped me and my family.”

Merryl, Texas, September 2021

More Frequently Asked Questions

How Much Can I Borrow?

With Dime Alley, you can find title loans ranging from $100 to $35,000 – with the amount you can borrow based on factors like your monthly income, credit status and affordability.

Other things come into play too, including your residence (homeowners are often preferred), age and whether you have any other similar loans open too.

Am I Charged a Fee for using Dime Alley?

No! We will never charge fees for using our service.

Instead, we take a fee or commission from the lender if your application is approved and successful. The lenders will charge a daily or monthly interest if your loan is active and this will be presented to you in writing before you proceed.

Can I Get a Loan with No Credit Check?

Dime Alley will consider those looking for no credit check loans, but note that a credit check is usually carried out for all customers. In this case, you may be presented a collateral product, using your car or home as an asset to borrow money.

What is the Repayment Period on my Title Loan?

Customers can repay over 1 month to 60 months (or equal to 5 years) – this will depend on whether you prefer the payday option which may be just a few weeks or months, or the longer installment option which can be several years to stretch out your repayments.

Payments are usually made in equal monthly installments from the bank account you choose and you always have the option to repay early if you would like to do so.

Can I Get a Title Loan with No Credit Check?

Dime Alley will consider those looking for no credit check loans, but note that a credit check is usually carried out for all customers.

Is Dime Alley a Broker or Lender?

Dime Alley is a broker, meaning that if you’re approved, we don’t provide the funds for your loan directly. Instead, we connect you to a lender best suited to your situation from our trusted panel.

Do not worry though, your information is completely secure and will not be sent or shared with any other companies or third parties and we certainly will not charge you anything for using our service.