Best Installment Loans with Bad Credit

Apply Online Today!

For the best installment loans online, Dime Alley has a number of options to borrow up to $35,000 repaid over 3,6, 12 or 24 months. Use our online application for an instant approval and get your loan in 1 to 24 hours with bad credit and no credit check options too. Click on ‘Apply Now’ below to start your loan enquiry today.

How To Apply For Installment Loans in 3 Steps

What are Installment Loans?

By definition, an installment loan is a loan that can be repaid over a course of multiple repayments, rather than having to be paid back in one go. With Dime Alley, you can borrow money today and choose to repay over 1 to 60 months in monthly installments, whether you wish to borrow $500, $1,000, $5,000 or more. Enquire about:

- 30 day loans

- 90 day loans

- 3,6,9,12,24,48 and 60 month loans

What is the Difference Between Payday Loans and Installment Loans?

The main difference is that payday loans are often used for just 2 to 4 weeks for emergencies and repaid on the borrower’s next pay date from work. See also emergency same day loans. Payday products have strict regulation, including state price caps to ensure that they are not misused.

By comparison, installment loans are designed for borrowing larger amounts and spreading repayment over several months or years. So this could be less for an emergency but rather a big purchase or event, perhaps for a wedding, consolidating some existing debts or paying for a college education.

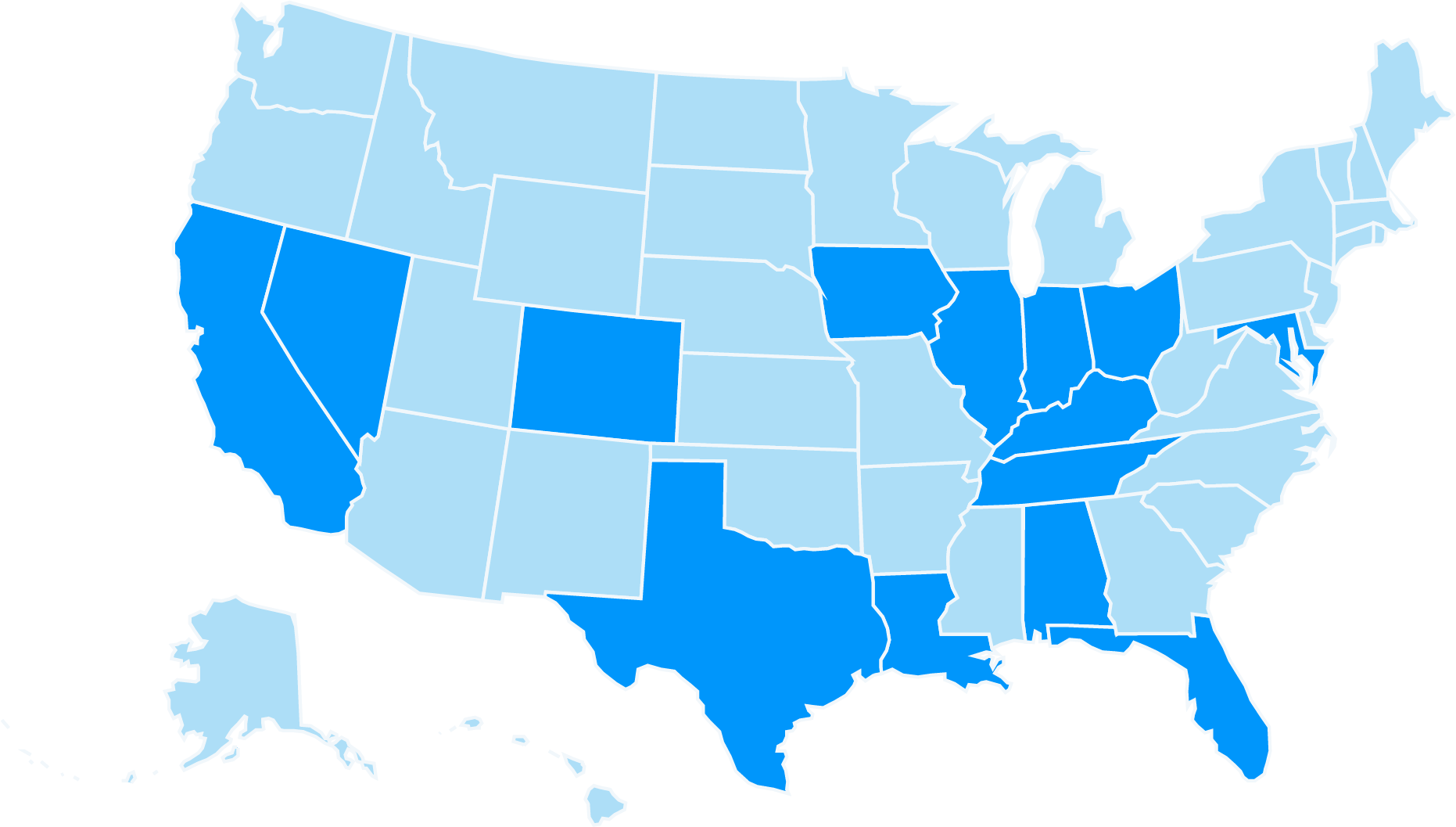

Where Can I

Borrow Money Near Me?

We proudly operate in the following US states:

What Are Online Installment Loans Used For?

- Personal purchases – Use installment loans for a number of purchases including a new car, wedding costs, to start a business, home improvements, childcare, tuition and more.

- Important expenses – You could use the loan in order to pay for any pressing costs such as a funeral, rent, medical bills, pet bills or for any costs related to moving house.

- Emergency installment loans – For those daily unexpected emergencies, installment loans may help with household repairs, car repairs, plumbing problems, boiler problems and more.

Where Can I Apply For Installment Loans Near Me?

Dime Alley offers installment loans across the the US, including the areas which are popular for payday loans including Alabama, California, Colorado, Florida, Iowa, Illinois, Louisiana Maryland, Nevada, Ohio, Oregon, Tennessee, Texas

With our loans connection service, we will match your loan enquiry with the best US lender based on your location, income, credit score and more, offering you the most competitive rates and the best chance of being approved.

We will also try allocate the best type of product for you, whether it is an unsecured product, or secured against your car or home, or completely alternative products from apps, credit unions, stores, banks, credit cards and more.

Whatever product we suggest, we will aim to process your loan request as fast as possible, with a quick decision and funds available within 24 hours or less.

How Do Installment Loans Work?

Installment loans work by allowing customers to borrow a fixed sum over several months, and pay it back over time, usually in equal installments. This approach may be preferred to other forms of fast loans, such as payday loans which only last a few weeks.

Some customers may prefer to receive the money upfront to pay for an emergency and have several months to pay it off, with the option to repay early if they would like to.

- Receive a fixed sum upfront – You will be able to borrow an amount based on factors such as your income, credit score and affordability – and you can receive money immediately to pay for any important purchases, personal reasons or emergencies.

- Fixed interest rate – You know exactly how much you are paying each month and at what rate, with no surprises or changes to the rate during the loan term. This can give you peace of mind and therefore you know exactly how much to budget for.

- Early repayment – You can repay early at any time and often save money because less interest is being accrued overall.

Representative Example:

Good credit: Borrow $30,000 at 10.99% APR for 60 months. Interest to pay: $652.12 per month. Total to repay: $36,652.12

Bad credit: Borrow $1,000 with 100% APR over 12 months. Total interest: $620 per month. Total repayment: $1,620

What is The Regulation for Installment Loans?

| Loan Amounts | $100 to $35,000 |

| Loan Term | 1 to 60 Months |

| Rates | 6.99% to 400% APR |

| Accept Bad Credit | Yes |

| Direct Lenders | Yes |

| Fixed Interest | Yes |

| Early Repayment | Yes |

What Information Do I Need To Get Installment Loans?

The information you need to apply includes:

Am I Eligible for Online Installment Loans?

Yes, you can apply for an installment loan with Dime Alley as long as you meet the following criteria:

With most of the products being unsecured installment loans, you can typically enter your details along with how much you wish to borrow and how long for – and you will be able to get an instant approval on the screen. This amount of information is sufficient for our lenders to check your credit score and eligibility for a loan. Once subject to further checks and approved, you can receive funds usually within 1 hour, 24 hours or the same day of applying.

| Payday Loans | Installment Loans | |

| Loan Amounts | $50 to $2,000 | $100 to $35,000 |

| Fixed Rates | Yes | Yes |

| Loan Term | 2 to 4 weeks | 1 to 60 months |

| APR | 6.99% to 36% APR | 200% to 400% |

| Bad Credit OK | Yes | Yes |

| Early Repayment | Yes | Yes |

Can I Get Installment Loans with Bad Credit and Guaranteed Approval?

Yes, we offer installment loans for bad credit histories, so even if you have been turned down elsewhere, we have a number of options available for you. To be eligible, you must be in regular employment and have a stable income and you are committed to repaying your loan on time.

Whilst traditional unsecured and payday loans will need you to have a good credit score, our installment lenders are designed to work with people who have bad credit and very poor credit too.

By making multiple repayments, it allows you to spread the costs over time which can be more suitable for those with bad credit scores. Plus, we have a number of options including secured and title loans which allow you to leverage any collateral or assets you have to borrow money.

Yes, it is possible to get guaranteed installment loans, since Dime Alley works with such a large panel of lenders that we are always able to give you some kind of loan offer or decision. The best products will be unsecured and carry low rates starting from 6% APR, with a number of other options such as payday loans, credit unions or secured loans for those with bad credit.

A loan however is never fully guaranteed, since this will always be subject to final checks, which could involve a phone call to confirm some information, proof of income via a pay stub or bank statement and sometimes proof of your employment.

Can I Apply for Installment Loans With No Credit Checks?

If you are looking for installment loans without checks, this is possible, since we offer products that involve using collateral or assets to be eligible, such as those secured against your home, apartment or car.

For no credit check loans, You will still need to be employed either full-time or part-time and have a regular income to show that you can afford to repay your loan without falling into financial difficulty.

Types of Installment Loans

Unsecured installment loans – your installment loan is not secured against a property or other collateral such as your car (with title loans). Your eligibility is based on income, employment and credit score and if you cannot repay, it will negatively impact your credit score, but you will not lose any valuable assets.

Personal installment loans – For personal expenses and purchases including home improvements, buying a new car, debt consolidation, weddings, holidays, parties and more – this is for you as an individual borrower and not on behalf of your business or similar.

Secured installment loans – This is a loan repaid over several months or years which is secured against a valuable asset that you own, such as a car or home. You will be able to borrow a percentage of the asset’s value (e.g 25%) and if you struggle to repay, your lender may be able to stake a claim in the asset or repossess it.

What People Say About Us

![]()

“Personal and friendly, they did what they said they would do, I was approved for a loan although I have bad credit. It was just a short term thing, but has helped me and my family.”

Merryl, Texas, September 2021

![]()

“Had a good experience and got my loan the next day. I needed it to pay my bills and will consider using it again if I need a loan.”

Darryl, Michigan, February 2023

![]()

“I found Dime Alley on Google and applied in a few minutes. I got an instant decision and approved on the same day and was able to pay to have my car repaired immediately. I paid back the loan in 2 weeks and was sorted.”

Bob, Florida, July, 2021

Frequently Asked Questions

Is a Payday Loan Installment or Revolving?

A payday loan is more likely to be classed as an installment loan if repaid over several months, such as 3 or 6 months. But typically payday loans are used for emergency purposes, so money is borrowed upfront in one lump sum and then repaid on the customer’s next pay date, which is usually around 2 to 4 weeks time. Payday loans are not considered to be revolving, because the loan stops at the end of the month, whereas loans which continue month-after-month such as credit cards are considered to be revolving.

How Long Can I Repay my Installment Loan Over?

Customers can repay over 1 month to 60 months (or equal to 5 years) – this will depend on whether you prefer the payday option which may be just a few weeks or months, or the longer installment option which can be several years to stretch out your repayments.

Payments are usually made in equal monthly installments from the bank account you choose and you always have the option to repay early if you would like to do so.

Is it More Expensive to Borrow for Longer?

Yes, typically the longer you borrow for, the more expensive the installment loan will be. This is because your loan is calculated on a daily interest rate, so if you keep your loan for 30 days, you will be charged 30 days of interest, or if you have the loan open for 60 or 90 days, you will pay 60 or 90 days interest. Whilst it might be appealing to have the loan open for as long as possible, you may want to think about how long you really need the loan for or be prepared to pay it back early when you can afford to do so.

Can I Repay Early?

Yes, you will always have the option to repay your loan early and this will often save you money since more interest accrues the longer that you have your loan open for. There may be a minimum term that you will have to have your loan open for, such as 2 weeks or 1 months, so always check the terms of the lender.

You will also need to watch out for early repayment charges (ERCs) that you may have agreed to when you took the loan out. Even if your lender does not claim to have an ERC, you may need to be aware of other fees.

How Do Installment Loans Impact Your Credit Score?

Simply applying for an installment loan will not impact your credit score negatively, unless you made a ton of applications in a short space of time which some lenders view as being suspicious. By consecutively making your repayments on time, this will in fact improve your credit score, as you are considered to be more creditworthy. However, if you fail to make repayments on time, your credit score will be slowly be damaged.

Is Dime Alley a Broker or Lender?

Dime Alley is a broker, meaning that if you’re approved, we do not provide the funds for your loan directly. Instead, we connect you to a direct lender who is best suited to your situation from our trusted panel.

Your information is completely secure and will not be sent or shared with any other companies or third parties without your permission and we will not charge you anything for using our service.

Is an Auto Loan Considered To Be Installment?

Yes, an auto loan used in order to purchase a car or other vehicle is considered to be installment, because you are paying off the loan over 3 or 4 years usually in equal monthly payments.

What Happens if I Default on My Installment Loan?

If you miss repayments on your loan, you will usually be given around 24 to 48 hours to make payment without incurring any late fees or damage to your credit score. However, once your loan is in arrears, you may be charged a late penalty, added interest for any days the loan is left outstanding and this will negatively impact your credit score and this could make it harder to access traditional finance in the future.