Borrow $600 Online

with Dime Alley

Apply Online Today with Same Day Decision!

Dime Alley can help you borrow $600 today, no matter your credit history!

When you apply for a $600 payday loan, Dime Alley will connect your application to a US loan provider best suited to you and who can offer you the best rates. Submitting an application is quick, easy and has no impact on your credit score.

I Need To Borrow $600 – How Does It Work?

What is a Bad Credit Loan?

A bad credit loan can help people borrow money even if that have a bad credit score. Maybe you have missed some payments in the past, but this should not define your future. If your finances are improving and you want to ensure you pay your loan on time, you can certainly apply and get the loan you need.

It is not just your credit score that is considered, Dime Alley’s lenders will take into account various things including:

- Your age

- Your type of residence

- The amount you have asked to borrow with the lender

- Your income.

- Your employment status

- Your affordability

There are a range of different loan types that can be made accessible to those with bad credit, including certain payday loans, installment loans and secured loans too.

Representative Example

Borrow $600 over 3 months, at 400% APR, 3 repayments of $345.95, total repayable $1037.85.

Where Can I Borrow Money Near Me?

How Fast Can I Borrow $600 Loans with Dime Alley?

You can receive your $600 loan from Dime Alley within 24 hours of applying. When you submit your application, we review it and connect it with one of our trusted lenders. We aim to provide you with a match within one day of applying so you can receive your money the very same day.

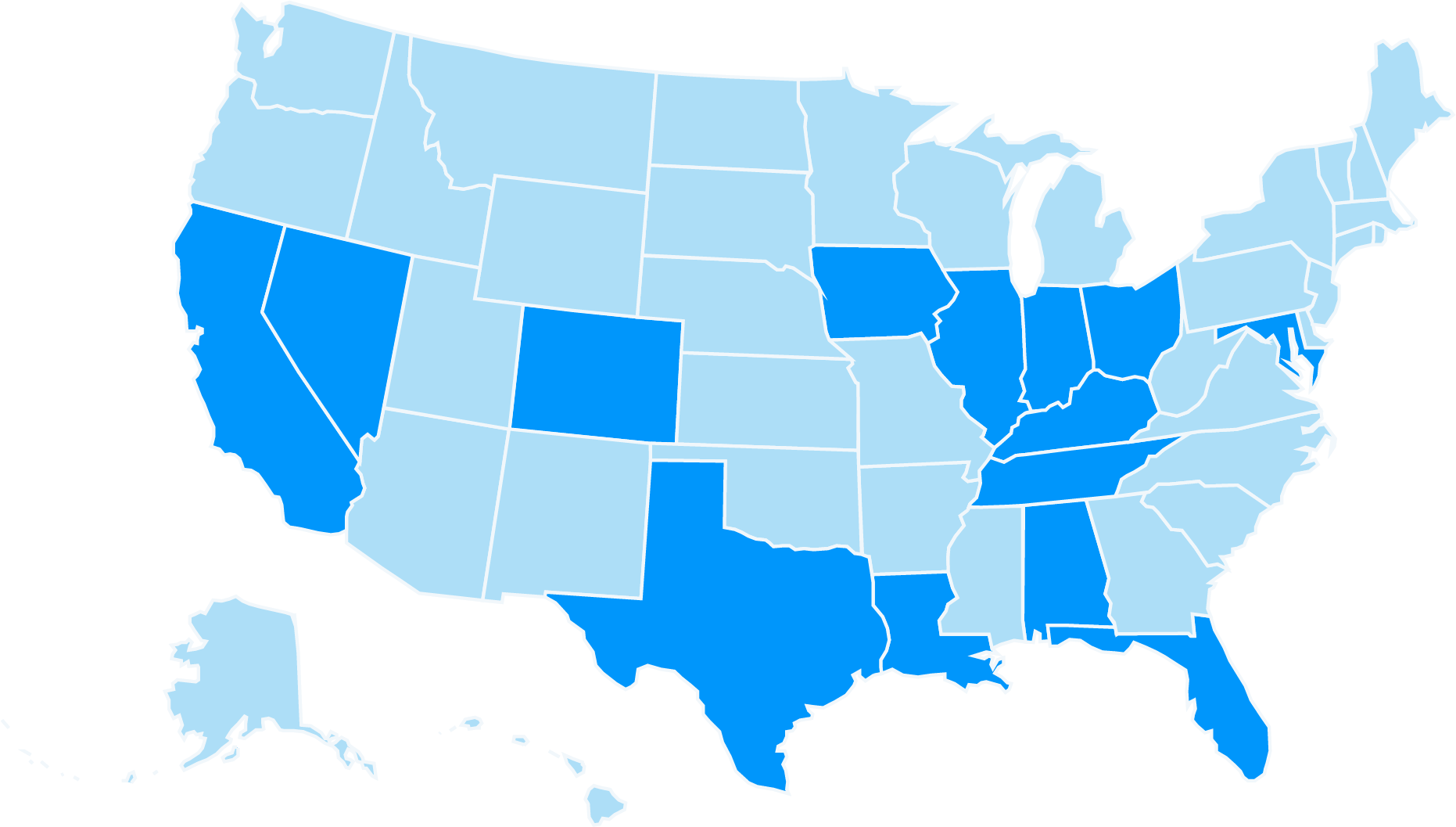

We proudly operate in the following US states:

Which States Can I Borrow $600 Loans?

Payday loans are legal in 37 states, and we operate in those states. The biggest states for payday loans are California, Nevada and Texas.

Some of the states we offer loans in have restrictions on how much you can borrow, and some have limits on interest applied to loans, such as Colorado and South Dakota.

Some states have prohibited payday loans altogether, including New York and New Jersey.

How Do I Repay a $600 Payday Loan?

Repayments on a $600 loan will be withdrawn monthly from your checking account on a date decided by you and your lender. Typically, this date will be your payday.

Payments are usually given in equal amounts with the opportunity to pay your loan off early. However, you should be clear on the repayment terms before deciding to alter your repayment plan.

Can I Borrow $600 Payday Loan With Bad Credit?

Yes – you can apply for a $600 loan with Dime Alley no matter your credit history.

Our trusted team of lenders lend to borrowers with all kinds of credit histories, and will provide you with the best available rates.

We know that having an imperfect credit history can be stressful when trying to secure a loan. That is why we consider all applicants – to make stressful times that bit less stressful.

In fact, borrowing $600 and paying it off as agreed can actually improve your credit record, making it easier to borrow in the future.

What People Say About Us

![]()

“Had a good experience and got my loan the next day. I needed it to pay my bills and will consider using it again if I need a loan.”

Darryl, Michigan, February 2023

![]()

“I found the experience overall easy to use. I had to sign an agreement online and all the terms were there and very clear. I would do it again if I needed some money.”

Imani, Georgia, March 2021

![]()

“I need a loan to pay back a friend and it was all very quick and easy to get a couple of hundred bucks which I repaid over a couple of weeks.”

Malik, California, December 2022

More Frequently Asked Questions

Can I get a $600 Loan with Bad Credit?

If you have a bad credit score, don’t worry – you can still get a loan with Dime Alley!

All credit histories are accepted. This means that you should still request a payday loan with us even if you have already been turned down by a bank because of bad credit.

What is the Repayment Period on my $600 Loan?

Customers can repay over 1 month to 60 months (or equal to 5 years) – this will depend on whether you prefer the payday option which may be just a few weeks or months, or the longer installment option which can be several years to stretch out your repayments.

Payments are usually made in equal monthly installments from the bank account you choose and you always have the option to repay early if you would like to do so.

Am I Charged a Fee for using Dime Alley?

No! We will never charge fees for using our service.

Instead, we take a fee or commission from the lender if your application is approved and successful. The lenders will charge a daily or monthly interest if your loan is active and this will be presented to you in writing before you proceed.

Where Can I Get a $600 Loan?

Loans for $600 are available in most states where payday loans are legal, but with a few exceptions where there is a cap on the amount you can legally loan.

For example, in Florida, it is forbidden to lend more than $500 for single-payment payday loans.

We advise that you check the payday restrictions in your state before applying with us.

Can I Get a Payday Loan with No Credit Check?

Dime Alley will consider those looking for no credit check loans, but note that a credit check is usually carried out for all customers.

Is Dime Alley a Broker or Lender?

Dime Alley is a broker, meaning that if you’re approved, we don’t provide the funds for your loan directly. Instead, we connect you to a lender best suited to your situation from our trusted panel.

Your information is completely secure and will not be sent or shared with any other companies or third parties and we don’t charge you anything for using our service.