Payday Loans in Colorado and Denver, CO

Apply Online Today - No Credit Check Options Available

Get a payday loan in Colorado, CO with Dime Alley to suits your financial situation, whether you are in Denver, Colorado Springs or anywhere else in the state. Borrow $300, $500 or $1,000 to help you through your time of financial need. Apply online today and receive your funds in as soon as 1 hour!

How to Apply for Payday Loans in Denver and Colorado in 3 Steps :

Why Choose Dime Alley for Payday Loans in Colorado?

Dime Alley can offer you a fast and easy way to get a Payday Loan in Colorado. Using our loans connection service, we can help find a lender that suits your needs, and, if accepted, you could receive your funds within minutes!

Payday Loans can be a great option to tide you over until your next payday in your time of financial stress. We all have financial difficulties from time-to-time, but rest assured, Dime Alley will help every step of the way.

Am I Eligible for a Payday Loan in Colorado?

In order to qualify for a payday loan in Colorado, there are only a few simple criteria that you need to meet to have a chance at being approved!

- You must be a US resident, over the age of 18.

- You should have a stable, regular income, earning a minimum of $800 per month.

- You should have a valid mobile phone account and a live checking account (for your loan to be deposited into).

How Much Does a $300 Payday Loan in Colorado Cost?

Borrow $300 over a two-week term, will cost $345 ($15 per $100) based on a representative APR of 400%.

Source: ConsumerFinance.gov

Useful Guides

How Long Will it Take to Get a Payday Loan in Colorado?

Receiving a payday loan in Colorado could take as little as an hour, or sometimes as soon as the next business day!

With Dime Alley, your online form is sent to lenders across Colorado, and you’ll receive an instant decision. If your request is accepted, you’ll find the money in your account as fast as possible.

What to Consider Before Getting a Loan in Colorado?

You should first check that you meet the eligibility criteria (see above) before you apply. Make sure you consider whether you can afford to meet the repayments on time.

In the case that you are unable to repay your Colorado payday loan, interest may be added. Not repaying your loan on time may also affect your credit score. It would be best if you thought about how much you actually need to borrow before getting started.

Does Dime Alley Offer Payday Loans in Denver?

Yes! Dime Alley offers payday loans in Denver, as well as all other major towns and cities in Colorado. Our process is all online, which means you can even apply for a payday loan whilst lying in bed!

We proudly cover all areas of Colorado, including Denver, Colorado Springs, Aurora, Aspen, Boulder and more!

Does Dime Alley Offer Loans in Colorado With Instant and Guaranteed Approval?

Yes, when you make a loan request, we will be processing thousands of data points to give you an instant approval right away. You will see the loan offer pop up and you can choose to proceed if you wish.

We are able to provide an offer for all enquiries and types of customer, including those with very good credit and those with no credit at all. You application will always be subject to further checks and once approved, you can receive your loan on the same day of applying.

Can I Get a Payday Loan with Bad Credit in Denver?

If you are looking for loans for bad credit in Denver and Colorado, we have a number of affordable options across payday, unsecured, secured, title loans, credit unions, apps, stores and more. We work with a diverse range of lenders and many of whom specialise in loans for people with bad credit histories – and they have a number of options for you.

As long as you are regularly employed and have a steady flow of income coming in, you can certainly borrow money today and get the loan you need. In some cases, you may need to provide proof of income or a bank statement, and in cases you may need your home or car as some form of collateral.

Whilst you may be looking for loans without credit checks, we have a number of options for those with very bad and poor credit scores.

Can I Get a Title Loan with Bad Credit?

Yes, you can get title loans with bad credit when you apply with Dime Alley.

Our lenders work with borrowers with all kinds of credit scores and histories – good and bad – so don’t let a poor credit score stop you from applying online today.

In fact, if you have bad credit and get an auto loan with Dime Alley, if you make sure you repay your loan on-time and in full, it could actually help to improve your credit score! This is because our lenders and any future lenders will see that you are a responsible borrower.

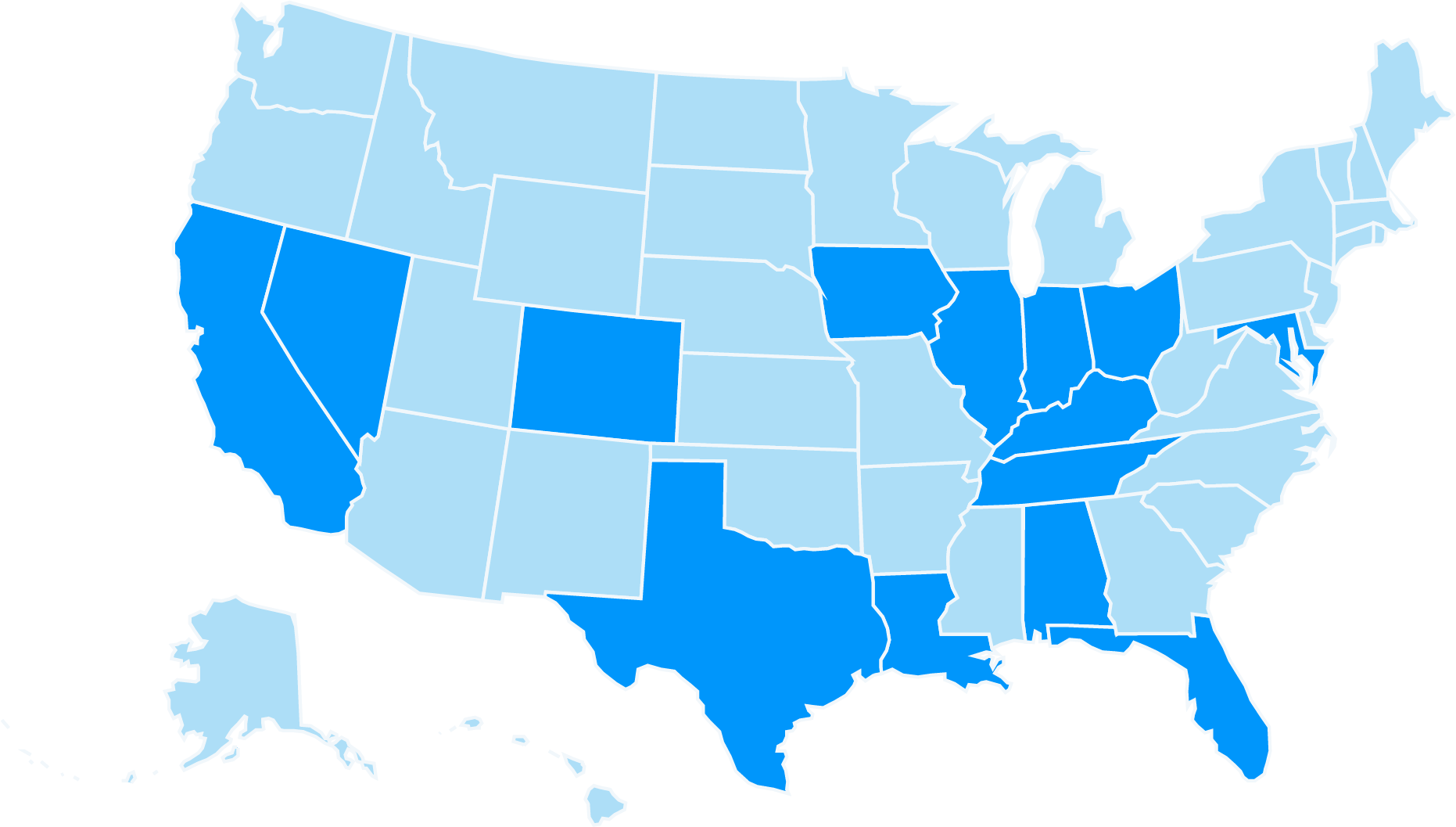

Where Can I

Borrow Money Near Me?

We proudly operate in the following US states:

Can I Get a Same Day Loan with Bad Credit?

Yes, Dime Alley can facilitate bad credit loans on the same day of applying. The entire process is online and you can apply 24 hours a day, 7 days a week, using your desktop, mobile or tablet.

Once approved and you have passed all the credit and affordability checks, you could have access to your funds within a matter of hours. To boost your chances of getting an emergency same day loan, try to apply during office hours and make sure that all your information such as income and expenses are ready and prepared.

What Are The Types of Bad Credit Loans?

The most common option is a payday loan for bad credit, which might be just $300 or $500 to help see you through until your next payday from work. You will need to show a stable income and employment and a commitment to paying on time – hence your credit score should be improving to get access to this kind of product.

Other options available from Dime Alley may include title loans which are secured against a vehicle such as your car or even a home loan, using your property as collateral. It can take just a couple of days to verify your assets – just note that you could risk possible repossession if these are not repaid on time.

Can I Get Emergency Loans with Bad Credit?

Yes, you can get approved for bad credit loans for emergencies, such as an unexpected medical or veterinary bill. You can borrow $600, $800 or even borrow $3000 to get back on your feet.

When it is an emergency loan, we appreciate that you will need cash quickly, so with an instant decision and fully online process, Dime Alley can approve your loan on the same day and sometimes, you can receive money to your bank account in just a few hours, and you’ll be considered even if you have bad credit.

Does Dime Alley Offer Bad Credit Loans Guaranteed Approval?

We cannot offer guaranteed bad credit loans, but we can help to match your personal details and loan requirements with the lender who is most likely to approve you and offer you the most affordable rates.

At Dime Alley, we are delighted to offer a free solution where you can apply with multiple lenders at once, with no fees for using our service and no impact to your credit score either. A loan can never be guaranteed and an individual will always need to be approved and show that they can afford to make their repayment on time and without falling into financial difficulty.

What People Say About Us

![]()

“Dime Alley helped me when I had an emergency. It was fast, simple and effective and I would recommend them to anyone who needs a loan.”

Jane, Nevada, November 2022

![]()

“Had a good experience and got my loan the next day. I needed it to pay my bills and will consider using it again if I need a loan.”

Darryl, Michigan, February 2023

![]()

“Personal and friendly, they did what they said they would do, I was approved for a loan although I have bad credit. It was just a short term thing, but has helped me and my family.”

Merryl, Texas, September 2021

More Frequently Asked Questions

Is There a Limit on The Number of Loans I Can Take Out in Colorado?

How Much Can I Borrow in Colorado?

Where Can I Get a Loan in Colorado, CO?

- Aspen

- Arvada

- Aurora

- Black Hawk

- Boulder

- Breckenridge

- Broomfield

- Canon City

- Carbondale

- Castle Rock

- Centennial

- Clifton

- Colorado Springs

- Commerce City

- Craig

- Cripple Creek

- Crested Butte

- Delta

- Denver

- Durango

- Edgewater

- Edwards

- Estes Park

- Evergreen

- Fairplay

- Florence

- Fort Collins

- Glenwood Springs

- Golden

- Grand Junction

- Greeley

- Greenwood Village

- Highlands Ranch

- Idaho Springs

- Lafayette

- Lakewood

- Leadville

- Littleton

- Longmont

- Loveland

- Manitou Springs

- Northglenn

- Ouray

- Pagosa Springs

- Parker

- Penrose

- Pueblo

- Rifle

- Salida

- Silverton

- Steamboat Springs

- Sterling

- Telluride

- Thornton

- Vail

- Westminster

- Winter Park

- Wheat Ridge

- Woodland Park

Does Dime Alley Charge Fees For Applying?

How Fast Can I Receive My Loan?

Is Dime Alley a Broker or Lender?

Dime Alley is a broker, meaning that if you’re approved, we don’t provide the funds for your loan directly and don’t charge you any fees. Instead, we connect you to a lender best suited to your situation from our trusted panel.