Bad Credit Loans Guaranteed Approval

Apply Online Now - Borrow $500, $1,000 or $2,000 Today - Bad Credit Accepted

Get a Payday Loan, Installment Loan or Cash Advance with No Credit Checks with Dime Alley today. We offer a range of products that allow you to borrow $500, $800 dollars or even up to $35,000 repaid over 1 to 60 months. Apply online for an instant decision and receive your loan within 1 or 24 hours!

How To Apply For a Loan With No Credit Check in 3-Steps:

Why Would I Need a Loan Without Credit Checks?

Maximise your chances of approval from one of our associated lenders by showing that you have a regular monthly income. By having this, lenders are reassured that you have a stream of income that can be put towards paying off you loan.

You should also avoid having more credit cards than you need. If you are building up piles of debt, lenders may deem you a high-risk borrower, and be unwilling to lend to you.

Importantly, you should be realistic with your demands when applying for a no credit check loan with Dime Alley. If you have a very low salary and a history of not paying off debt dependably, you should not request a particularly large loan.

Finally, anything you can do to improve your credit score, you should! You should remain familiar with your credit score so that you can work towards improving it.

Remember, if you do borrow through Dime Alley, and pay your loan off as you agreed you would, this will go towards improving your credit score.

Where Can I Get a No Credit Check Loan Near Me?

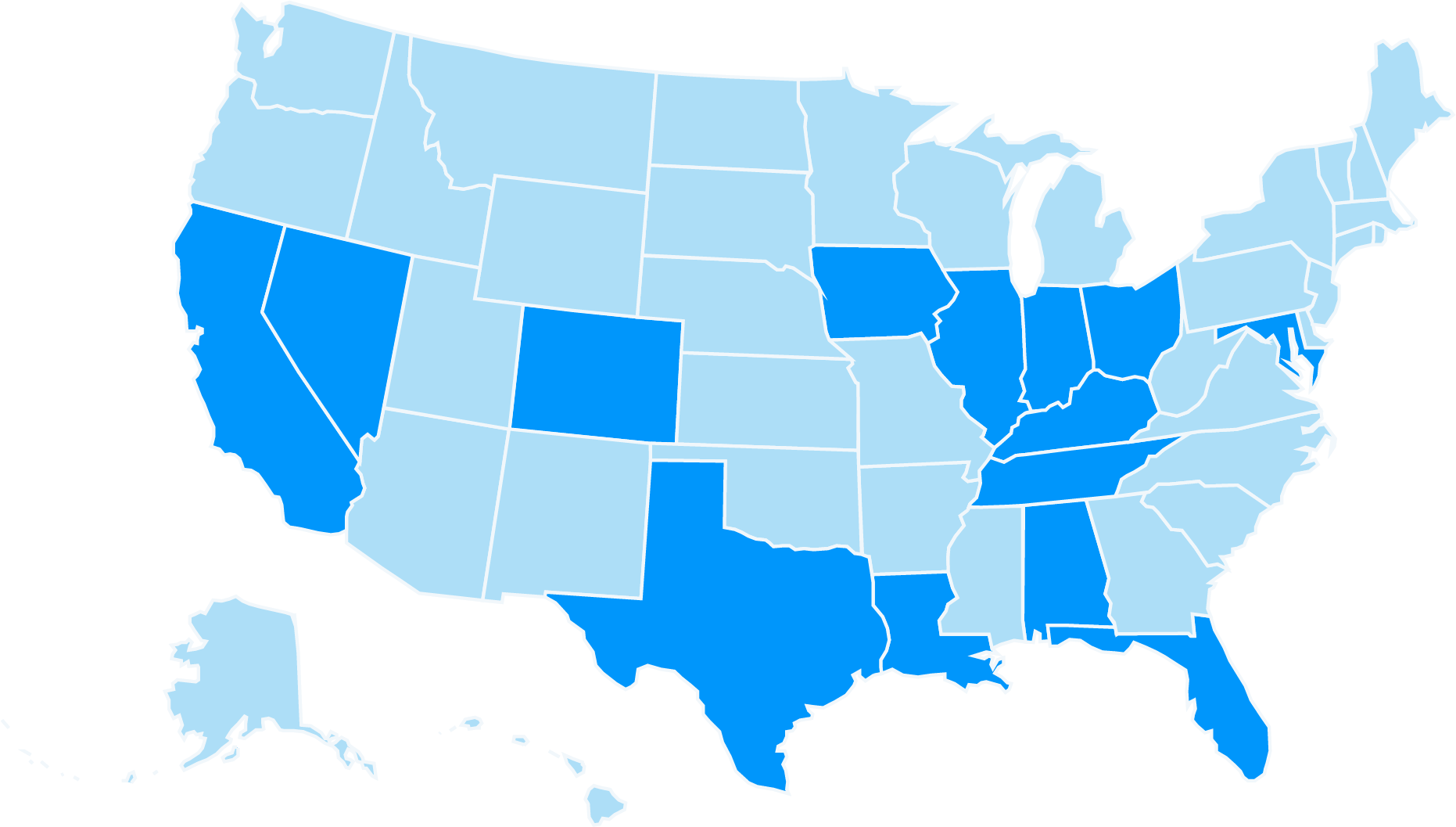

Depending on what state you live in, Dime Alley can help you secure a loan without having to undergo a credit check.

We work with many US payday lenders and short-term loan providers who are willing to prioritise factors other than your credit score when deciding whether to approve your loan application.

Dime Alley helps you find these loans in the US states that authorize them. For example, we can provide loans in Texas, California, Alabama and Florida. Unfortunately, we can’t offer loans where payday lending is prohibited, such as in New York.

To manage risk, the lender we match you to may adjust how much you can borrow, or ask for some collateral.

If your application with Dime Alley is approved, your funds will be deposited into your checking account within 24 hours of applying. As a lending partner, we work quickly and effectively to make trying times that bit easier.

Am I Eligible to Apply for a No Credit Check Loan with Dime Alley?

Yes, if you meet the following criteria, you are eligible to submit a loan request with Dime Alley today:

- Over 18 years old

- Hold American citizenship

- Have a checking account for us to deposit your funds into

- Have a minimum monthly income of $800

- Steadily employed

Where Can I

Borrow Money Near Me?

We proudly operate in the following US states:

Why Should I Use Dime Alley to Secure a No Credit Check Loan?

Dime Alley is a responsible broker who only works with regulated and trusted lenders. We are passionate about helping consumers during difficult financial spells, so we ensure that the same values are found in all of the lenders we introduce to your customers.

When you take out a loan with Dime Alley, there are no hidden fees. If you apply for a loan and it is approved, we will receive a commission directly from the lender. This means that you incur no unnecessary costs.

Dime Alley’s service is personalised. Our matching system means that your application will be connected to a lender who is committed to helping customers with records like yours. This means you will be offered the best available terms on your loan.

How Can I Apply for a No Credit Check Loan with Dime Alley?

Click ‘get started’ today to begin our quick, easy and free application process for fast cash loans.

Before applying, you should be confident that a no credit check loan is right for you. If you have alternative means of support, such as loans from friends or family, you should visit these options before committing to repaying a loan.

If you decide that applying for a loan with Dime Alley is right for you, you should proceed with our online application, which will take you less than five minutes to complete. You can fill it out at any time.

We will ask for a few details, such as your date of birth, how much you hope to borrow, how long for, and your employment status. You will then get an on-screen instant decision and, if approved, can receive your funds within 24 hours of applying. Sometimes you’ll receive your cash even faster!

How Do Repayments Work with Dime Alley?

When you take out a loan through Dime Alley, you and your lender will decide on a date each month, which will likely be your pay day. On that date, repayments will be withdrawn from your checking account for the duration of your loan agreement.

Repayments are typically made in equal monthly instalments, plus interest. See installment loans for more information.

You will be reminded when funds are withdrawn from you account, to prevent any surprises.

Can I Get a Loan without a Credit Check?

Typically, we will need to conduct some sort of credit check when you apply for a loan with us.

However, you should rest assured that we only conduct soft credit checks ourselves when you apply. These have no impact on your credit and won’t leave a footprint either.

What People Say About Us

![]()

“Personal and friendly, they did what they said they would do, I was approved for a loan although I have bad credit. It was just a short term thing, but has helped me and my family.”

Merryl, Texas, September 2021

![]()

“I need a loan to pay back a friend and it was all very quick and easy to get a couple of hundred bucks which I repaid over a couple of weeks.”

Malik, California, December 2022

![]()

“I found the experience overall easy to use. I had to sign an agreement online and all the terms were there and very clear. I would do it again if I needed some money.”

Imani, Georgia, March 2021

More Frequently Asked Questions - Bad Credit Loans

How Much Can I Borrow with Dime Alley?

With Dime Alley, you could find loans ranging from $100 to $35,000 – with the amount you can borrow based on factors like your monthly income, credit status and affordability.

Other things come into play too, including your residence (homeowners are often preferred), age and whether you have any other similar loans open too.

Am I Charged a Fee for using Dime Alley?

No! We will never charge fees for using our service.

Instead, we take a fee or commission from the lender if your application is approved and successful. The lenders will charge a daily or monthly interest if your loan is active and this will be presented to you in writing before you proceed.

Can I Repay Early?

Yes! Typically, you can always repay your loan early with us.

However, there may be early repayment fees that are incurred as a result, but these will always be stated in your loan terms.

What is the Repayment Period on my Loan?

Customers can repay over 1 month to 60 months (or equal to 5 years) – this will depend on whether you prefer the payday option which may be just a few weeks or months, or the longer installment option which can be several years to stretch out your repayments.

Payments are usually made in equal monthly installments from the bank account you choose and you always have the option to repay early if you would like to do so.

Can I Get a Loan if I'm Unemployed?

It can be trickier to get a payday loan if you are unemployed, and it is usually more difficult than getting a loan while you have steady income from a job.

However, for the 6.88 million unemployed US citizens there are alternatives to payday loans, such as Credit Union loans, which offer low APR rates of around 8.86%.