Get Payday Loans in Maryland, MD, & Baltimore

Check Your Eligibility Now - Borrow Online Today!

With Dime Alley, you can get a Payday Loan or Installment Loan ASAP with a rate and fees that suit your needs in Baltimore or in any other city in Maryland. Just fill out our quick and easy application form, and, if approved, you could receive anywhere from $100 to $35,000 in your account within the hour!

Our 3-Step Process For Maryland, MD, Payday Loans:

Why Choose Dime Alley for Payday Loans in Maryland?

If you’re looking for a bit of extra cash to help you through to your next paycheck or to pay an unexpected bill, such as a medical or veterinary bill, Dime Alley can help you to find a payday or installment loan to suit your needs.

If your application is accepted, you could receive the money in your account in just a few short hours!

We all have times of financial hardship, but rest assured, at Dime Alley, we are there to help you get through it!

What Should I Consider Before Getting a Payday Loan in Maryland?

You should first check that you meet the eligibility criteria (see above) before you apply. Make sure you consider whether you can afford to meet the repayments on time.

In the case that you are unable to repay your payday loan, interest may be added. Not repaying your loan on time may also affect your credit score. It would be best if you thought about how much you actually need to borrow before getting started.

Am I Eligible for a Payday Loan in Maryland?

Before you request a payday loan, you should consider whether you meet the conditions necessary. Not everyone is eligible for a payday loan in Maryland, so be aware of the requirements and stipulations. There are four main conditions to be eligible:

- You must be a U.S. resident.

- You have to be at least 18 years of age.

- You need to have a consistent income with earnings at a minimum of $800 per month.

- You must have a checking account that your Maryland payday loan can be deposited into.

If you pass all of the above criteria, then feel free to go ahead and apply and we’ll do the rest!

How Can I Get a Payday Loan in Maryland?

If you request a loan through Dime Alley, you can easily find a speedy payday loan in Maryland.

At Dime Alley, we do the hard work for you; we work with direct lending companies across Maryland to find you a loan. We offer a fully online experience with almost instant decisions to make the process as straightforward as possible.

There’s no need to leave the house or approach multiple lenders simply enquire online today and let Dime Alley do the rest.

Does Dime Alley Offer Payday Loans in Baltimore?

Yes! Dime Alley offers payday loans in Baltimore as well as all other major towns and cities in Maryland. Our process is all online, which means you can even apply for a payday loan whilst lying in bed!

We proudly cover all areas of Maryland, including Baltimore, Columbia, Germantown, Waldorf, Silver Spring, Frederick, Ellicott City and more.

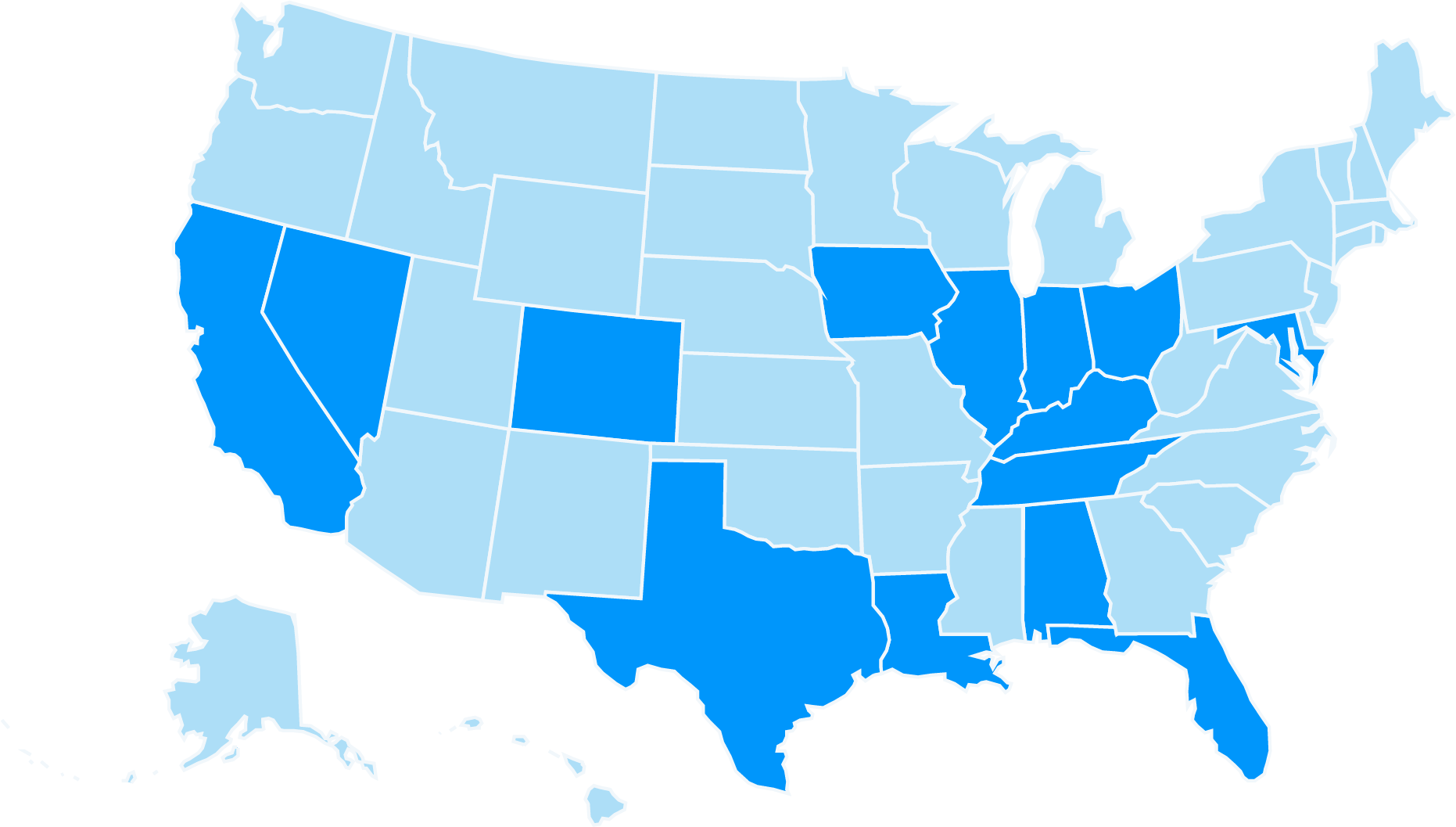

Where Can I

Borrow Money Near Me?

We proudly operate in the following US states:

Can I Get a Car Title Loan in Maryland?

Yes, you can get a Title Loan in Baltimore or any city or town in Maryland MD!

Title loans in Maryland work similarly to title loans in other states although Maryland has some specific laws to protect you, the borrower.

Generally, title loans work by providing a loan amount of 25% to 50% of the vehicle’s value and using your vehicle as collateral. Because they are secured loans, the lender can repossess the car if you fail to meet the terms of the loan.

How Do Repayments Work with Payday Loans?

Maryland payday loans are repaid over two weeks to five years in equal monthly instalments. If you need to cover a one-off emergency bill, a couple of weeks may be long enough to get you to your next paycheque.

For large sums, you may need to spread out the repayments more. You can choose to repay your payday loan in equal instalments each month up to five years! You are also always able to repay the loan early to save money on interest.

What People Say About Us

![]()

“Personal and friendly, they did what they said they would do, I was approved for a loan although I have bad credit. It was just a short term thing, but has helped me and my family.”

Merryl, Texas, September 2021

![]()

“I need a loan to pay back a friend and it was all very quick and easy to get a couple of hundred bucks which I repaid over a couple of weeks.”

Malik, California, December 2022

![]()

“Dime Alley helped me when I had an emergency. It was fast, simple and effective and I would recommend them to anyone who needs a loan.”

Jane, Nevada, November 2022

Maryland Loans | Frequently Asked Questions

How Much Can I Borrow in Maryland and Baltimore?

With Dime Alley, you could find payday loans ranging from $100 to $35,000 – with the amount you can borrow based on factors like your monthly income, credit status and affordability.

The maximum amount of loan that MD Loan Regulations allow from Payday Loans is $1000 for multi-payment loans. However, for one-time repayment loans, Payday lenders allow a maximum loan amount of $500 to the borrowers.

Can I get a Payday Loan with Bad Credit in Maryland?

If you have a bad credit score, don’t worry – you can still get a loan in Maryland!

With Dime Alley, all credit histories are accepted. This means that you should still request a payday loan with us even if you have already been turned down by a bank because of bad credit.

What is the Price Cap on Maryland Loans?

In Maryland, online and store lenders wishing to operate in the state have to comply with the 33% APR cap.

What is the Repayment Period on my Payday Loan?

Customers can repay over 1 month to 60 months (or equal to 5 years) – this will depend on whether you prefer the payday option which may be just a few weeks or months, or the longer installment option which can be several years to stretch out your repayments.

Payments are usually made in equal monthly installments from the bank account you choose and you always have the option to repay early if you would like to do so.

Am I Charged a Fee for using Dime Alley?

No! We will never charge fees for using our service.

Instead, we take a fee or commission from the lender if your application is approved and successful. The lenders will charge a daily or monthly interest if your loan is active and this will be presented to you in writing before you proceed.

Is Dime Alley a Broker or Lender?

Dime Alley is a broker, meaning that if you’re approved, we don’t provide the funds for your loan directly. Instead, we connect you to a lender best suited to your situation from our trusted panel.

Do not worry though, your information is completely secure and will not be sent or shared with any other companies or third parties and we certainly will not charge you anything for using our service.